Business interruption insurance model for the self-employed

Unlike employees, who are covered by unemployment insurance, freelancers and intermittent workers have no insurance to compensate them financially in the event of a drop in orders or no orders at all. Syndicom, a trade union in the communications and media sector, has developed a model to fill this gap: the APA-I loss-of-business insurance scheme.

Unlike employees, who are covered by unemployment insurance, freelancers and intermittent workers have no insurance to compensate them financially in the event of a drop in orders or no orders at all. Syndicom, a trade union in the communications and media sector, has developed a model to fill this gap: the APA-I loss-of-business insurance scheme.

Annette Dannecker

78% of the self-employed and intermittent workers surveyed by syndicom indicated that the current system did not allow them to build up sufficient financial reserves, if at all, to protect themselves against a loss of income. That's why we've developed a loss-of-activity insurance scheme, financed in equal parts by the self-employed person and their principals.

As music teachers are often partially or wholly self-employed, business interruption insurance is an exciting approach to consider.

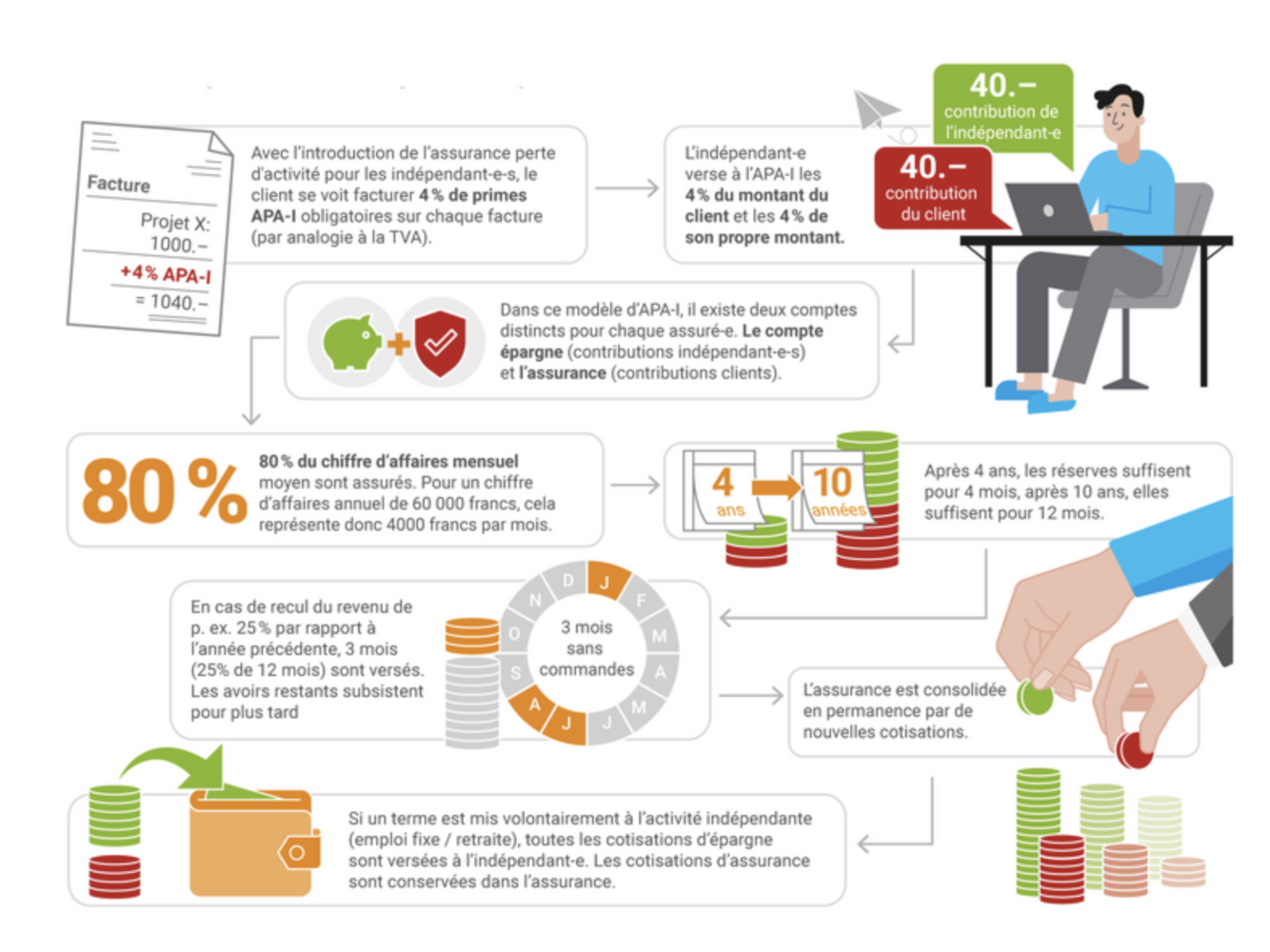

In principle, each mandate - in our case, a music lesson or a semester contract - gives rise to an additional contribution of 4% to the CA, in the same way as the CA for employees. These 4% are paid into an insured person's account. Self-employed workers also pay 4% into an AC-E savings account. They therefore "own" two private unemployment insurance accounts, but cannot access them directly. Deposits in the savings account are returned to them when they retire or cease self-employment. This account is used primarily in the event of total or partial absence from office. Only then is the insurance account debited. The aim is to ensure that the absence of a mandate is not just an illusion, as this would be tantamount to deceiving yourself by withdrawing your savings. However, there would be no withdrawal of third-party funds. The insurance account remains in the possession of the insurance company in the event of retirement or cessation of self-employment, in order to maintain employment agencies similar to the ORP and to cover all administrative costs.

In the event of a total absence of orders, the self-employed person receives 80% of his/her average salary, so that he/she can continue to cover current expenses such as workshop rent, instrument maintenance and living expenses, and can concentrate on recruiting new students without any constraints.

But would our students be prepared to pay 4% more for a lesson, i.e. 104 francs for a lesson that used to cost 100 francs? Would our students bear this extra cost so that their teacher could be covered by social security? Or would teachers often have to pay the full 8% themselves?

The question arises as to whether insurance should be made compulsory in order to prevent a teacher from being left without cover in the event of a loss of mandate, either because he/she has not taken out insurance for fear of not being able to afford it, or because he/she feels that he/she cannot pass on the extra cost of 4% to his/her students. For further information on this model, please visit : www.syndicom.ch/fr/branches/communication-visuelle/apa-ipourlesindependant-e-s/

The model was put out to consultation in February, and everyone is invited to have their say.

Please send your suggestions for improvement to Annette Dannecker (annette.dannecker@smpv.ch), who will collate and forward them to syndicom. It will also be happy to answer questions on the loss-of-activity insurance model. The SSPM will be actively involved in this consultation and will accompany the process, as music teachers have different conditions to media professionals, and it is essential that these are taken into account when the model is finalized.